If you lived on a island completely made of sand, in the middle of nowhere, with no access to anything, all alone,

and had nothing but a treasure chest filled with a billion dollars, how rich were you really?

– George Gammon

Where liberty is, there is my country.

– Benjamin Franklin

How can we maximize our wealth using the world map?

There are currently 195 countries recognized by the United Nations, all with different governments, tax codes, laws, and passports. There are 180 currencies in the world, 66 of which peg their currency to the US dollar. The best passport in 2022 is Germany with visa free access to 127 countries. There is no passport that grants access to the entire earth. What country you are a citizen of, what currency you spend, and what country you live in can drastically change how your wealth is preserved. If you were a citizen of Afghanistan, lived in North Korea, and somehow managed to store all of your wealth in Argentinian pesos over the last half century, you would have had no freedom over your life. You had the freedom of Han Solo stuck in carbonite. None.

Nobility

Back in the day, if you wanted freedom you needed to be apart of the nobility, the noble class. If you were considered noble, you usually were born into it, and in some rare circumstances, could buy yourself a seat into it. Breaking the word down to its basics, to be noble is to be no-able, someone who was able to say no to anyone. If the government or warlord came to you and said “you must do x, by our decree”, a noble person could choose what they wanted to do instead of being forced. If something bad happened, are you able to survive and thrive? How noble are you in the world to it’s problems? Liberty is the ability to exercise freedom. How free are you really?

I. Citizenship

Two is one, and one is none.

-US Special Forces

Do you have a plan B passport if your current one is canceled?

Before 1900, there were no passports. You were who you were, where you were from, and a country or leader could allow you in, or ban your travel based on those facts, and it wasn’t until the 1950’s you could be recognized as a dual citizen. Times have changed. Based on your citizenship, you may already have access to most of the world, but do you only have one passport? During wars, and pandemics, your freedom to choose where you want to go in the world restricts dramatically. During peak COVID, the US passport was only allowed entry into 6 countries on earth. If you had passports and residencies in other countries, your freedom to travel the world opened up. No lock-downs for you. There are parts of the world still on lock-down today in December 2022 (China) two full years later. Some countries are forcing people to be vaccinated to “join” the others in society, and threatening to take away everything if they do not comply. You are slave to your country’s dictates.

The US congress has a large majority of senators and representatives who have a plan B citizenship and passports with other countries in case their US passport fails them. The term “government” means “mind control” in Latin. And we “trust” them to govern (make decisions) on our behalf with no conflict of interest. They need to keep the cattle in the gates to survive.

Getting a second citizenship can be simple, but not easy. You are usually going to have to make a trade for time, money, and deal with headaches like government bureaucracy. If it was easy, everyone would be doing it, and countries would most likely start banning or make the process even more strenuous. The second passport you obtain should increase your travel visa free to countries you would like to gain access to. Better late than never, because you might not have access to leave your country when you truly need it. If you don’t have a passport, get one. And if you don’t have a plan B passport, start working on one.

II. Residence

Tax is theft

– anonymous

The problem is not that people are taxed too little. The problem is that government spends too much.

– Ronald Reagan

The US didn’t have an individual income tax for the first 137 years, and became a world power during this time. Most countries squander your taxes, and are poor stewards of your wealth. In some cases, they use your taxes for evil government programs that harm individuals, track and even incriminate you if you do not fall in line, destroying freedom. You might even have a moral obligation to pay as little in taxes as possible to not feed this ugly system. You’re paying for your own demise essentially. The percentage of tax you pay is your percentage of slave you are to their system. To combat this, lower your tax burden, and reside in a tax haven. You don’t even need to live there in some cases. This is the country in which you legally are a tax resident, pay taxes in, at a tax rate of 0% or as close to 0% as possible (0% slave).

III. Assets

Own nothing, but control everything.

– John D Rockefeller

You will own nothing, and be happy.

– Klaus Schwab

Is there an optimal way to protect assets?

Wealthy families have been using asset protection structures for centuries to keep assets hidden and protected from the public eye. What you don’t technically own can not be taken from you. A trust is a legal entity that has a trustee (not you) hold assets on behalf of beneficiaries (you and fam). An ideal asset protection structure would have an offshore anonymous irrevocable trust at the top with you as its beneficiary. This trust would own LLCs (limited liability companies) with the trust as its manager. The LLCs would own all of your assets, real estate, cars, bank accounts, and safety deposit boxes. None of this should have your name on it. This arrangement allows you to pass assets to beneficiaries, avoid probate in court post-death for heirs, and also lower tax.

IV. Currency/Banking

How do you gain access to the currency generated by these assets?

Poor banking destroyed your hard earned currency’s purchasing power (like Argentina), and in some cases you were locked out of your funds (like Lebanon). You want to set up bank accounts in stable banking jurisdictions, and ideally has no reporting to entities like the CRS (common reporting standard) and FATCA (USA – foreign account tax compliance act). Something like Switzerland with banking secrecy laws, but doesn’t cave to US information sharing pressure like Switzerland did in 2015.

Since the whole world is basically on a dollar standard, the demand for dollars to pay off debt is increasing, and leads to a strong dollar vs other currencies world wide (see Brent Johnson’s Dollar Milkshake Theory). This allows people holding dollars the ability to buy more goods and services as foreign currencies devalue over the coming years. Dollar arbitrage. Your US dollars will purchase more overseas. If you are worried about the US dollar, alternative currencies like the United Arab Emirati Dirhams (AED), Singaporean Dollars (SGD), and even gold will work to preserve purchasing power against foreign currencies so you can have more for less.

V. Playgrounds

Go where you’re treated best.

– Andrew Henderson, Nomad Capitalist

Get your money’s worth.

– Dad

Where do you want to spend time?

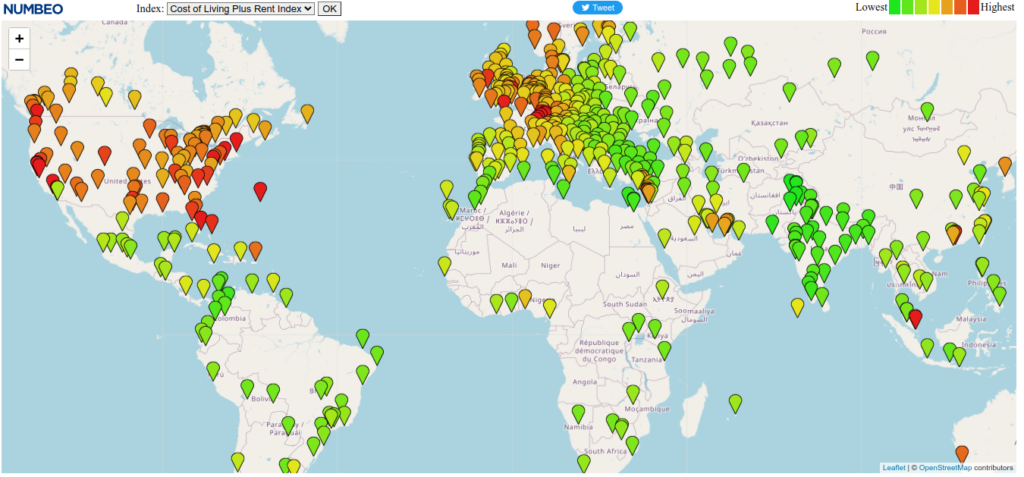

Whenever money leaves your hands, ask yourself, am I getting a good deal? Am I living well? Could I be living better? In some countries you might pay double or triple for the same item or service. In some countries, the currency is devaluing rapidly, where you can live extravagantly at a lowered cost. With currency arbitrage your quality of life appreciates. Your money goes further. Why pay more when you can pay less? This is ideally in a country where the government respects personal property rights, and isn’t seeking control over your decisions in life (restricting movement), or concerned with your wealth by taking (taxing/inflating) it away.

‘I wish to make money for myself and my clients, and I have no desire to live life as a slave. Consequently, I’ll seek out the best for myself… Arbitrage is defined in the dictionary as: The simultaneous purchase and sale of equivalent assets or of the same asset in multiple markets in order to exploit a temporary discrepancy in prices. The arbitrage between what value is still perceived to be in many Western “developed” markets and some developing or even developed countries (Dubai, for example) is still wide.’

– Chris McIntosh

By being a tourist and spending less than 180 days in each country, you generally circumvent government concerns over you and your actions there (assuming you are obeying the local laws). This is where the term “perpetual traveler” came from. Harry Schultz, the original Flag Theorist, taught this back in the 1960’s, and is still applicable today. Andrew Henderson from Nomad Capitalist teaches the Trifecta method, where you may have three or more playgrounds and spend ideally less than 120 days in each country, never falling in that countries tax net.

Diversification

The diversification advice your financial planner should really be about using Flag Theory to optimize your wealth. Work on diversifying your citizenship or residencies, assets, and lifestyle. You might have two (or more) citizenships with passports in a country like St. Lucia or Grenada, residence in a non-taxable country like the United Arab Emirates, control assets in safe haven jurisdictions such as the Caymans or Jersey, banking in a non-CRS non-FATCA country, while living and spending time in countries with a depreciating currency (Latin America) gaining a higher quality of life. Control assets all owned by anonymous offshore LLCs, owned by an anonymous offshore trust, and nothing in your name. You will own nothing, and be happy.

This is just an introduction to the world of Flag Theory. I do not want to disclose the names of more jurisdictions to put extra cross-hairs on them, but they do exist and flag theorists are using these global tools every day to better their life. No one country will offer all of this in one package, so you must look to greener pastures, and open up an atlas. Start becoming a world citizen today by planting new flags.

Big brother should never know who you are, where you live, how you make your money,

where you keep your assets, and perhaps the most important: where you like to play.

– Harry Schultz