Can it be done?

When the US entered WWII in 1941, I wonder if President Roosevelt would know that the winner of this war would rule the world for the next 100 years. In 1944, the allied world restructured the monetary game in Bretton Woods, New Hampshire. The US was a major producer of world goods, and became a safe haven for gold during the war times of WWI, and WWII. The world agreed that they would settle trade, and hold reserves in dollars, which was tied to a fixed price in redeemable gold, and allowed bankers (and politicians) sleep easier during these troubling times. The reserve currency at the time was the Pound Sterling from the United Kingdom, which had ran its course both as an empire, and as an international currency reserve due to extreme debt loads from the world wars, crumbling influence over international seaways and foreign powers, and extended money printing. The pound’s time was up, and the new kid on the block was the US dollar. Since then, the United States has became the world reserve currency. In 2022, 80% of international trade has been done with US dollars, and 60% of the savings from other central banks is in US dollars. The dollar is still king, and the world is enslaved to its dictates. The US can print 35% more in currency reserves, like they did during the coronavirus pandemic, directly diluting its value, and the world doesn’t bat an eye. There is no alternative (TINA), the popular acronym describing this phenomenon. “The cleanest shirt in the hamper.”

If the world was to change from a dollar standard as the settled currency of international trade, we might want to take a look at the most important part of world economies to understand what would be first to change if there was a currency change. All economies are dependent on energy consumption. If there is no energy, there is no 21st century economy. A large reason why the US won WWII was due to energy whether it was the discoveries of oil in the middle east during these times, to the cutting off of Japanese oil which may have provoked Pearl Harbor. The US was the largest oil producer in the world, and still is today due to the shale oil boom. Energy is the base layer of an economy, without it, the world goes into crisis.

The Organization of the Petroleum Exporting Countries (OPEC) was founded in 1960 in Baghdad by its founding five members: Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela. During this time, the demand for energy from oil was growing because the world economy and population was growing. OPEC found that they had the majority of oil reserves, and would band together to try to control its price, and influence in international markets. During this time, the US dollar was in crisis due to its backing in gold, and their overspending government. The world called its pegged to gold bluff and started handing in their dollars for gold, Nixon panicked and defaulted on the promise to the entire world that they could exchange their dollars for gold in 1971-72. Who would lose the most from this? OPEC. They would be trading their only physical commodity they had in exchange for a piece of paper that represented nothing, but what could they do? They had no army, and was dependent on the US for military support.

During this time, OPEC met with the International Monetary Fund (IMF), the World Bank, and others to discuss the potential to settle their oil for something other than fiat US dollars for their international oil exports. If they would not be able to exchange oil for gold, they were looking for a currency that was liquid, stable, and globally accepted other than the US dollar. They looked at a basket of currencies, which had its problems of weighting favoritism, stability issues, illiquidity, or wasn’t globally accepted. There was no alternative because much of the countries in the world had dollars and little gold in their accounts at this time due to their agreement from Bretton Woods so they unfortunately had to stay dependent on the dollar as settlement. The only other alternative for OPEC was to not produce oil, and keep it in the ground. This was difficult to due since these countries already spending money and needing to export something to pay the bills or they would go bankrupt, leading to collapse. Also, the rest of the world would produce oil at almost any price because they also had bills to pay, so controlling the price through production at the time was a fools errand. So OPEC continued to produce and export oil, and recycled their excess reserves into US Treasury bonds that at least had a nominal yield, in a stable, liquid, globally accepted currency, with blessing and protection of the US.

After the collapse of the USSR in 1991, the US was the only standing super power on earth. They truly ruled the world in global trade, and gold was a “relic” defined by Ben Bernanke, head of the US Federal Banking system. The US was untouchable, until 9/11/2001. During the 2000’s he US government would begin wars in the middle east, and conduct financial war games to further understand the use of US dollars as a mechanism for economic war. If the dollar failed, the entire global economy would fail. In Jim Rickard’s 2011 book Currency Wars: The Making of the Next Global Crisis, Jim went into great detail about simulated government currency war games, and the potential linchpin of the world economic system. It had been over 40 years since the US de-pegged from gold, and that would prove to become the dollar’s only hidden weakness. If US’s enemies ie China and Russia, began to accumulate gold, and issue a currency to the world backed by gold, that was liquid, and stable, world trade would prefer to settle in this new currency, and abandon the dollar. With such high debts, and less demand, the US dollar would collapse in value. All of these exported US dollar reserves would come home worthless.

Is gold still a relic?

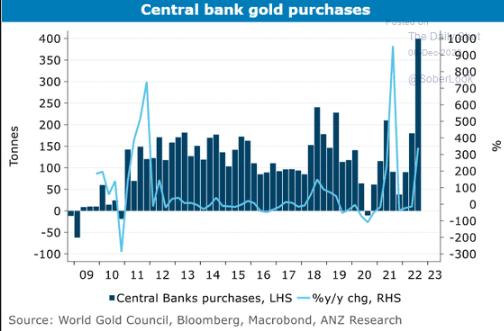

Since the 2000’s, China and Russia have been accumulating gold at record pace, but their real reserves are unknown today. China and Russia are the top producers of gold in the world and export very little if none at all, and China through Hong Kong accumulates an additional +1,000 tonnes per year through international markets. They may have more gold than the US and EU combined in 2022, which could be further reason why Putin invaded Ukraine. In an international financial poker game, gold becomes the chips, and whoever has the gold, makes the rules. Since 2016, central banks across the globe have been buying record numbers of gold bars in modern day history, and suppressing the price of accumulation through COMEX and LBMA futures contracts to do so. Central banks are realizing the global monetary system might be restructured, and gold will be apart of it.

US Dollar v Gold

The dethroning road map of the US dollar as the global reserve currency could look like like what Andy Schectman has described in a 4 part series of events:

1. April 2019, the Bank of International Settlements (BIS, the central bank of central banks) reclassifies GOLD as tier 1 collateral (the US dollar is the only other tier 1 collateral for bank loans).

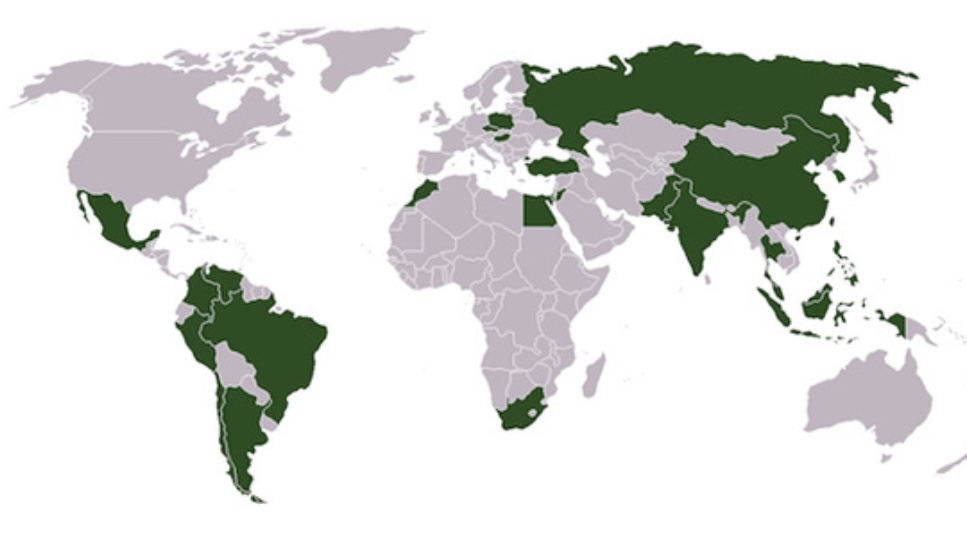

2. The Chinese one belt, one road initiative begins settling international trade in digital yuan, and the BRICS bank (Brazil, Russia, India, Iran, China, South Africa) begin growing in membership for international trade and economic development, with intent to replace the G7 (group of seven: US, UK, Canada, Germany, France, Italy, and Japan) as the new rulers of economic trade. BRICS nations have 48% of world population (vs 10%), 36% of global GDP (vs 29%), 45% of key commodities (oil, gas, iron ore, rare earths, vs 4%), and 58% of world food production (vs 8%). In 2022, Saudi Arabia has decided to join the BRICS bank along with Argentina, Iran, Nigeria, Turkey, UAE, and many other key countries. What was once a group of misfit toy countries, are now a banded conglomerate powerhouse, with new members turning their backs on alliance with the US.

3. In August 2021, the US fails and pulls out of Afghanistan, showing leadership weaknesses and unreliability to other countries. Saudi Arabia immediately signed joint agreements with Russia for military protection, due to their growth of military power in hyper-sonic missile unrivaled technology.

4. In February 2022, Russia invades Ukraine. They are kicked from Western G7 trade, and all assets stolen, proving safety concerns with using the US dollar as a reserve asset, and use of gold as a monetary asset. Russia increases trade with China by digital yuan, which can be converted into gold through the Shanghai Gold Exchange for liquidity. The BRICS bank issues a statement claiming they will continue implementing trade with Russia, and a further need to not us the US dollar for global trade.

So how does the US dollar collapse?

5. Saudi Arabia (and OPEC) join BRICS, and issue a statement that they will trade oil with the rest of the world through the BRICS bank, in individual currencies (or possibly the digital yuan). The rest of OPEC join and trade goods with China (and the rest of BRICS) with the ability to settle trade reserves into gold on the Shanghai Gold Exchange, while having military protection by Russia and China.

6. The US Treasury yield curve (and Eurodollar futures curve) have been inverted long enough now to indicate that a recession is most likely going to happen between 2023-2024 in the US economy. The yield curve inversion is undefeated at calling recessions, and the most reliable indicator. With debt obligations, and increased spending, the US will have to increase further deficits, and rollover the majority of the $31 Trillion debt burden (+$100 Trillion in unaccounted for unfunded obligations like social security and healthcare for the 60 million retiring baby boomer generation) all at higher interest rates, with lower tax revenue. The taxes from individuals and corporations won’t be enough to cover the interest expense. To not go insolvent, the government will have to take on more debt to pay off the old (robbing Peter to pay Paul) or revalue other assets such as gold to stay solvent, which still sits undervalued on their asset books at the recorded $35/ounce from 1971. The US is the world’s largest banana republic.

7. Strains of the global economic system from a strong US dollar. The whole world needs cheaper dollars to pay off their dollar denominated debts. This could be lessened from a weaker dollar, which is caused by lowering interest rates, and increasing government spending, but has the consequences of higher inflation, increased wealth disparity, and continued hollowing out the American middle class. The Federal Reserve Bank is not signaling they will cut interest rates any time in 2023. The US economy will continue to slow, weaken, lowering overall economic production, lowering overall economic demand, and lowering the velocity of money. Unemployment will increase. The Fed will try to reverse course, but they are always last to realized what issues they cause from monetary policy. The damage to the economy will already be done. The result could trigger a public adoption of central bank digital currencies (CBDCs) money deposited from an app to your account, which consolidates more power into the hands of big governments, and central banks to try to artificially stimulate economic demand. This could also persuade other countries to ditch the US dollar, and default on their US denominated debts.

The dollar may be king now, but the decline can be seen in the distance during the next few decades. In 2022, Stanley Druckenmiller (top world macro trader for George Soros) gave the US dollar less than 15 years for being the world reserve currency asset, and countries across the globe gradually dump dollars for gold, and other currencies.

Further signals to keep a lookout for

1. The world deep states pushing the war in Ukraine or Taiwan toward a nuclear conflict (possibly by false flag measures), dragging in NATO (the US) into a world war. The world would instantly fracture into a US vs BRICs world.

2. The break up of the European Union from poor energy policy, and having to raise interest rates, further dividing the world into a bipolar US vs BRICS economic world.

3. African, and Latin American countries joining BRICS, and officially settling trade with each other in currencies other than the US dollar.

4. Increased accumulation of gold as a tier 1 reserve asset by Central Banks.

How much gold is prudent?

E.B. Tucker in his 2021 book Why Gold Why Now suggests holding 3-4% of his personal net worth in physical gold. Ray Dalio suggests a 7.5% weighting of gold. Jim Rickards suggests 10%. Anywhere in this range serves as portfolio insurance if the dollar were to rapidly devalue and should be owned before the crisis. Both warn of owning paper gold on stock exchanges due to hypothication fraud (more shares than actual physical gold in vaults), and the inability to redeem shares for the physical gold in a crisis. Warren Buffett may say that gold is a non-productive asset (does not grow in value), which is correct, and should not make up a large percentage of the portfolio. Gold is insurance for a currency that devalues rapidly, and should be seen as a currency, not an investment or speculation.

Store your gold wisely, and do not disclose how much you own to the public.