“It’s Not a Stock Market, It’s a Market of Stocks.”

– David Keller

“If you find 3 wonderful businesses in your life, you will get very rich. And if you understand them, bad things (over the long run) aren’t going to happen to those three.”

– Warren Buffett

The investing duo of Warren Buffett, and Charlie Munger are most likely the greatest investing pair of all time. Over the last half century, academic professors in economics touted the “efficient market hypothesis,” that stocks were perfectly priced at all times. They were being handed Nobel prizes. These academics considered Warren Buffet (et. all) to be just a statistical anomaly, a fluke. Academics thought his compounding of 2x the market average, year over year, for +60 years was just like a group of monkeys flipping coins, and he was the lucky one getting heads over and over. Just pure luck. Academics taught that no one should try to beat the average stock market’s returns, and should be diversified in +500 companies in an index fund to minimize risk of company failure, a permanent loss of capital.

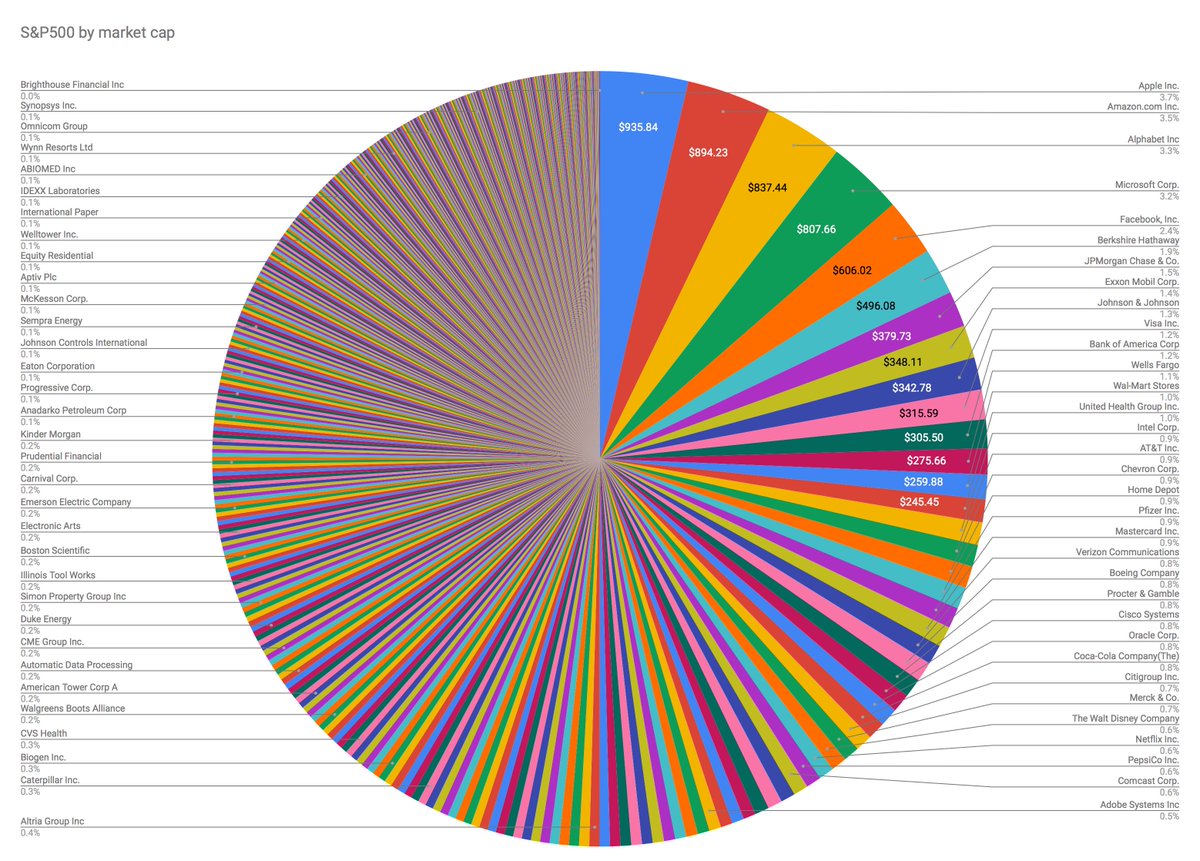

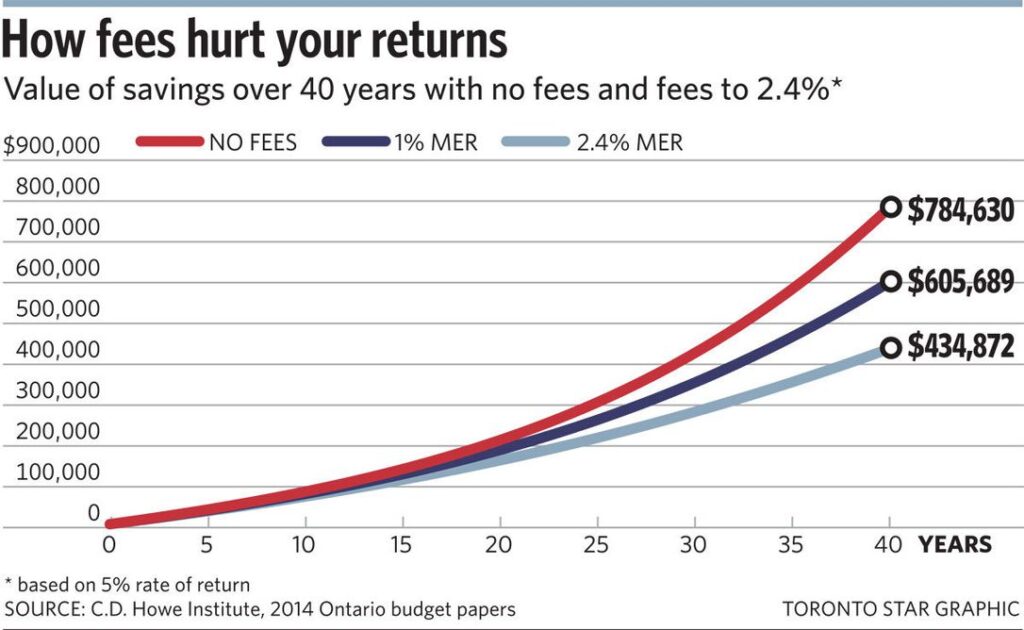

Even Buffett agreed that most people should be invested in the S&P 500 if they are not in the business of understanding the value of individual companies, and that they are speculators if they don’t. He even made a $1 million dollar bet with fund managers that they couldn’t outperform the S&P 500 index over a 10 year span, and that their fee structure they were charging their clients was hurting their overall returns. These fund managers are like a herd. They tie their performance to the S&P 500, and mostly build a portfolio that is similar in composition to the index, so that investors do not leave. They charge a high 2% (or 1%) fee each year, regardless of the funds performance, and make themselves rich off investor ignorance.

Most people who have retirement funds are invested in index funds like the S&P 500, and bond funds, in a 60/40 split allocation. If you only have the option to invest in funds like these, you are unable to choose individual stocks, and are forced to buy the entire index. There are long periods of time (20 year periods) where the S&P 500 makes 0% returns: 1903-1921, 1929-1956, 1965-1983. You would have lost money in real returns if you bought the S&P 500 during these times.

These funds are also filled with companies you may not ethically support (take a look under the hood), and nearly 20% are zombie companies which need cheap debt (low interest rates) to keep financing their companies operations or they will go bankrupt. They do not make enough each year to pay back the interest alone on their debt. Hence, they are called zombie companies, the living dead.

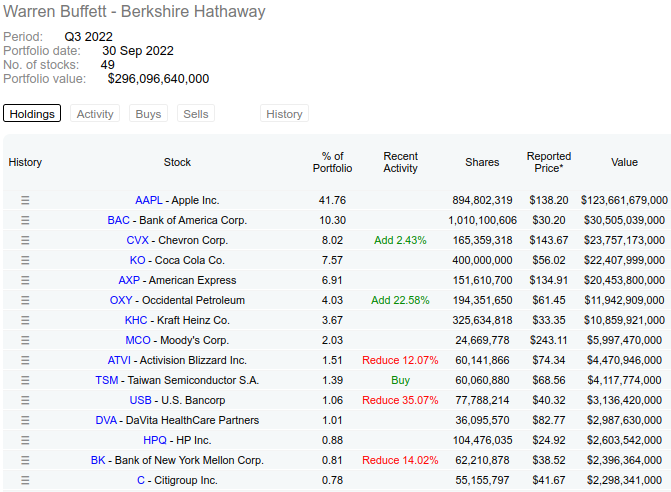

If this is your only method of investing, you might want to consider Warren Buffett’s advice, and move your retirement into just the S&P 500 (lowest fee) index, the top 500 performing companies in the United States, and out of low yield bonds or other funds. Warren Buffet himself has instructed his trust to put his entire net worth into an S&P 500 index fund when he dies, and sell all his Berkshire stock. He only owns one stock (Berkshire Hathaway). Berkshire Hathaway is a conglomerate of private and public companies. In the stock picking division, Warren (and Co.) have been recently buying undervalued energy companies in 2022.

He and many other similar investors are required to post their individual stock buys each quarter in a 13F report to the public, and can be found on websites like Dataroma, Whale Wisdom, and Valuesider if you are interested in finding stock buys to clone. These investors have already screened these companies worthy of investment from their point of view. There are some flaws: most international picks are not required to be disclosed, and your looking at the past, not the present. These investors could have already sold once these reports are disclosed. Realize that not all of these investors are completely like Warren Buffett holding +80% in 10 or fewer companies. You can get a feel of their conviction of each company by their concentration. The lower the concentration, the more similar they will be to an index fund, in which you should just buy the S&P 500 index. These are companies should have a high rate of return on invested capital, consistently high growth rates year-over-year, with low debt, and great managers, all at a reasonable or low price. Only invest in these companies once they are in your circle of competence (you understand the business and competitors completely). Some of the best investors include: Charlie Munger, Li Lu, Chuck Akre, Mohnish Pabrai, Guy Spier, Nick Sleep, David Einhorn, Bruce Berkowitz, and Bill Ackman. Warning: do not just look at the list and become a speculator. Due your own due diligence if the company is in your circle of understanding. If you have to ask, it probably isn’t. Stick to the S&P 500 index or buy Berkshire Hathaway (BRK.B). Warren is still the CEO.

“In Turkey (2019), everyone (Western Investors) had exited the market due to macro concerns (currency devaluation, interest rate hikes, Pres. Erdoğan’s policies, etc.), and I had found a warehouse operator (stock) that was trading at a total market cap (you could buy the entire business outright) at $20 million. This warehouse operator had total assets valued at $800-900 million, and each warehouse had an instant bid if they wanted to call a broker to sell each one. These warehouses were leased to long-term companies like IKEA, and Amazon outside of Turkey, in Euros, so they had a tailwind each time the Turkish Lira devalued. Their debt was in Turkish lira. In 2022, Turkey has been one of our best investments. So the micro, trumps the macro.”

-Mohnish Pabrai