Money is gold, nothing else.

– J.P. Morgan 1912

While testifying to U.S. Congress

Fiat currency is not money, only gold is money and everything else is fiat.

All fiat currency’s value across time have all gone to zero.

– Mike Maloney

Hidden Secrets of Money Series

Money, or really currency, is one half of every transaction on Earth. Think about it. You walk up to a counter, hand the cashier physical cash, a plastic card, or even scan a QR code, and you in turn receive something of value or a service. They get pieces of paper, and you get the goods. We trade so much of our time for this currency, to eventually get future goods or services. It might be worth investigating what currency is, where it came from, and how currency can be used for and against us.

Studies with monkeys and a commodity currency show insight into how our ancestors millions of years ago may have used a medium of exchange for goods and services.

Original Money

Original money was bartered goods. I traded my horse, for some of your crops. You traded your chickens, for my land. It wasn’t until tribes that humans started to use smaller items such as weapons, and commodities such as gold, silver, wheat or rice was used to settle economic trade. Some tribes used sticks as currency, some used giant stones. By the time of the ancient Greeks, gold and silver started to hit the “main stream” as a settlement of trade, though bartering was still the method of settlement. Gold, silver, and small commodities worked as money due to its durability, portability, fungibility, scarcity, can be used as a unit of account, and is a store of value. It was desirable by most humans, and was scarce. It naturally became the method of settlement, and its use has lasted over 5,000 years. All the gold that was used and traded 5,000 years ago is still here today.

Where did paper currency come from?

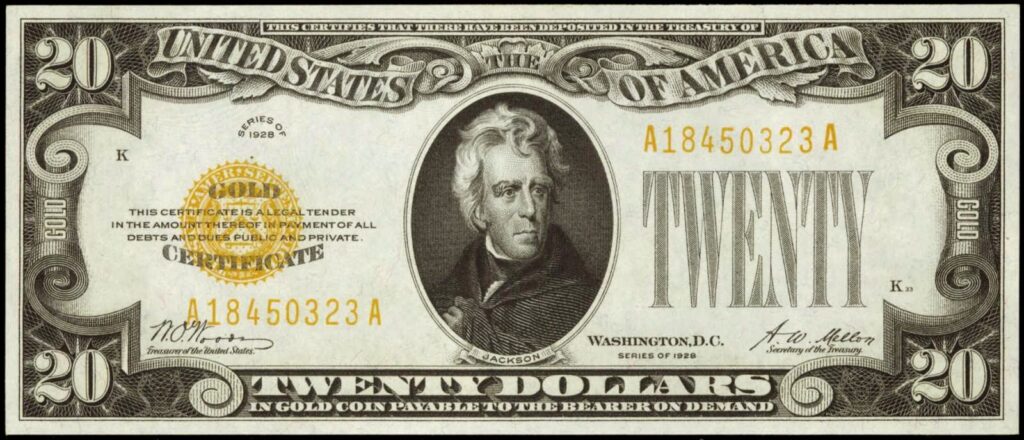

Goldsmiths, the original bankers, gave clients who stored their physical gold & silver physical receipts. These receipts were called certificates. It became quite convenient to trade these physical receipts instead of running to the bank, and bringing back physical gold or silver to complete each transaction. To incentivize customers to keep the gold in the bank, the bank would offer interest on gold stored in the bank. The bank would relend the vaulted gold to entrepreneurs by issuing debt called bonds which allowed these entrepreneurs to set up shop, and pay back the principle owed plus interest.

Banking grew, economies grew, wars were fought, with some banks failing along the way, which lead to economic busts, and public distrust. As a result, some economies only used gold and silver as money, and nothing else. In the United States, for the first 137 years, there were only two central banks ever created, which had 20 year charters, in which they would dissolve. Silver was technically the only money defined as a weight of silver in the constitution, and that only gold and silver could be made as legal tender.

Paper is poverty. It is only the ghost of money and not money itself.

– Thomas Jefferson 1788

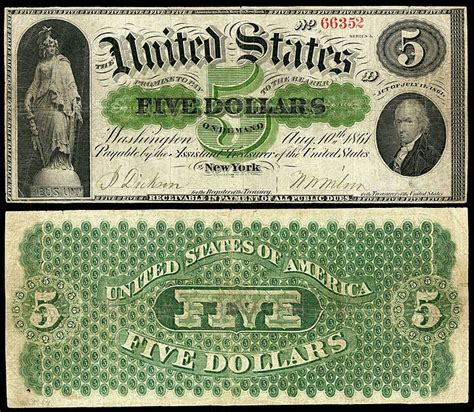

During the civil war, there was a need to fund this expensive war. The north issued currency notes known as greenbacks to fund the war. The original term “greenback” was a negative term for these notes because these notes did not have secure financial backing, and banks were reluctant to give customers the full value of the dollar in physical metal redemption. In essence, the promise was a lie. There were more printed notes, than physical silver on deposit at the bank.

It wasn’t until 1873 that bankers were able to persuade US congressmen to pass a law making only gold currency across the land, trying to demonetize silver as a use for trade settlement. The majority of Americans used silver as a means of trade other than bartering. This created a shortage of money, which lead to farms failing, and runs on banks, which lead to massive bank failures. William Jennings Bryant was a politician from Kansas in 1896 ran for president, running on the presidential campaign to make silver money again due to banks robbing the saving productive workforce, defaulting on their promises, which put strain on the working man to pay back their debts.

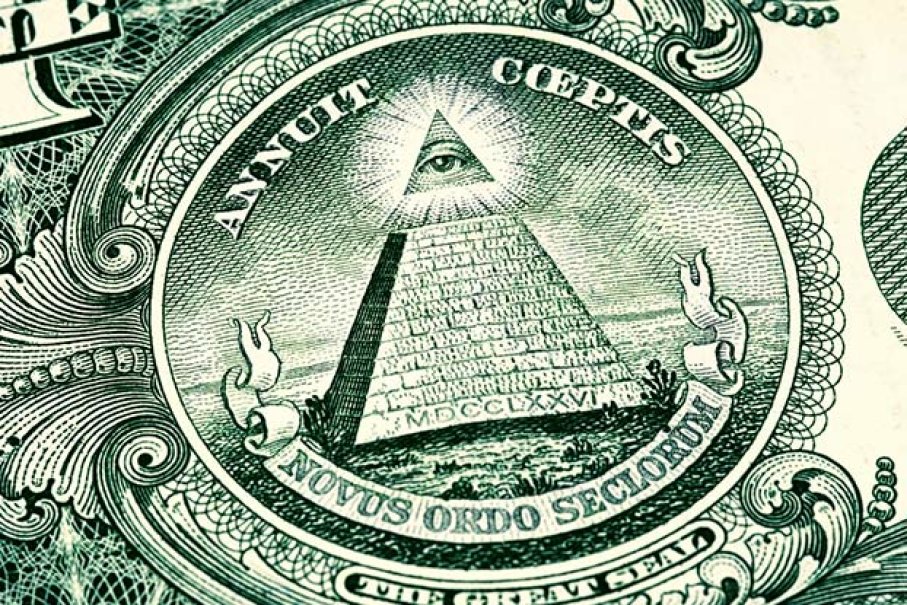

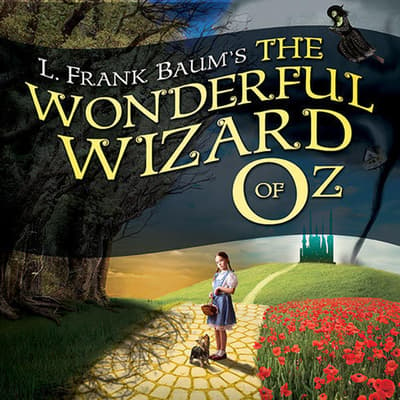

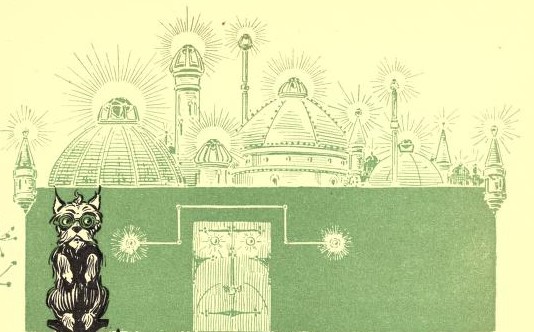

The whole incident was front row to author L. Frank Baum who wrote The Wonderful Wizard of Oz in 1900. The Wizard of Oz was an allegory of the largely agrarian farmer which made up the majority of economic commerce in the United States. Dorothy’s slippers were made of pure physical silver in the book, in which the wicked witch wanted them because they were powerful. Dorothy didn’t understand why. It wasn’t until color films in 1939, that the production team used bright red shoes to catch the viewers eye, the ones we know today. The unit of measurement of gold, and silver in an ounce, which was and still is abbreviated to Oz. In the emerald city, the wizard made everyone wear green goggles so that they would believe their city was built from emeralds.

The Wizard was a metaphor for the bankers and politicians in Washington D.C. who pulled the political strings, trying to demonetize silver, leading the masses along the golden path with gold as money, and turning their gold into eventual green pieces of paper as value. Baum warned readers of where they were being led, like the greenbacks of the past, and how the wool would be pulled over their eyes. The Wizard was the equivalent to modern day ponzi, where the people were duped into thinking the green pieces of paper had power, but the system was just fiat, value by decree. Dorothy would discover the emperor has no clothes.

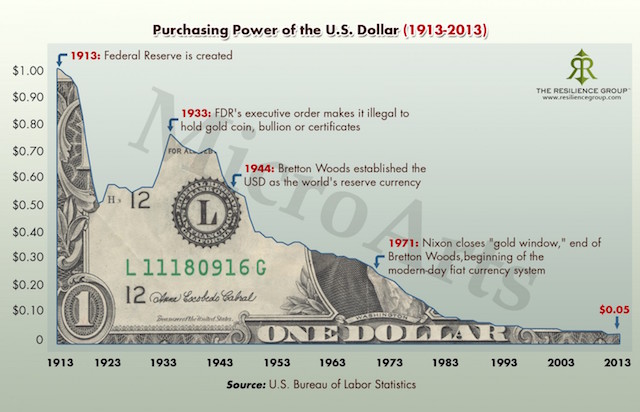

Money after 1913

After several banking panics, a group of elite bankers and politicians created the Federal Reserve banking system that would be independent from the federal government, and would pronounce a monopoly on all currency that would be issued within the boarders of the United States. This would eventually regulate all currency that would be issued, and would become the funding for US Federal Government debts. Subsequently the US federal income tax was also passed, which allowed the US government to tax its citizens on income earned.

Its incredible to think that the United States became a world economic power up to this point in 1913, only on a sound currency banking standard, no central bank, and no federal income tax. You could convert your currency into gold that was stored at the bank, governments couldn’t spend more than they earned, preserving the purchasing power of these gold backed receipts, and there also was no income tax. At the end of the 1800s, your money could buy more goods and services than it did at the beginning of the 1800s because this system was naturally deflationary due to increased productivity from a growing workforce, and constrained spending. You could just save in gold, and you became wealthier with lowered risk. No need for increased risk in stocks, bonds, real estate, or crypto. I wonder what the value of $1 will buy in the year 2050, if the US dollar will even exist.

World War I, German Hyperinflation, Depression

Most world currencies in the early 1900’s were either on a gold backed currency standard or silver backed currency standard. When the world erupted in world war, European governments did not have enough silver and gold to wage a high cost war. Most suspended convertibility into gold or silver, and ran the printing press to fund the war. All the chips were on the geopolitical poker table. By the end of WWI, the UK, US, and French allies won, Germany and foes lost, who owed large sums to these bankers. Germany went into hyper inflation, having to constantly devalue its currency by running the printing press, and devaluing these debts owed. This led to a depression in Germany in the 1920s, with the eventual rise of nationalistic parties like the Nazis.

WWII, Bretton Woods, The New World Order

Most of the western world went into depression due to returning to original gold pegging with an increased currency supply. The increase of speculative lending grew their banking systems which lead to eventual busts and the great depression. The US government was in so much debt that Roosevelt made owning gold illegal, and devalued each note in circulation to pay off these debts. With the rise of the Nazi party, and WWII, the world went back into a currency spending spiral, further devaluing each currency from high government spending. The printing presses practically caught fire since they never stopped running to fund the second world war. It was clear that the United Kingdom was broke, and that there was a need for a new world currency for trade. In 1944 world bankers and economists met to discuss the new currency standard for world economic trade. The economic set up would be that the world would peg their currencies to the US dollar, which could be convertible to gold from the US Treasury. Everyone would trade in dollars, and could convert their surplus into physical gold. The New World Order.

Demonetizing gold as money in 1971 by Nixon

In 1971, US defaulted on its promise to the world to be able to redeem physical dollars into gold due to overspending. Since then, countries across the globe transact in is just a paper dollar bill backed by absolutely nothing but the fear of being cut off by the US from the world banking system. US citizens had to fight with congress to allow them the ability to own gold privately in 1975.

Have you ever examined a physical US dollar? Next time you get your hands on one, take a look at the top.

What is a note?

A note is a short term bond. A bond is debt, so a note is debt. We are all trading debt receipts. A bond is an agreement between two parties, a borrower and a lender, in which the borrower agrees to pay back the lender with interest. With a US federal reserve Note, the borrower is the United States Government (Treasury) and the lender is the Federal Reserve bank. A Federal Reserve note is really a 0% interest rate bond with no expiration, that can be used to pay for goods, services, and eventually taxes which goes back to the US government (Treasury) to pay back the debt with interest. This system keeps growing as there is more debt owed due to interest, than there are dollars in the total system. The Federal Reserve bank can raise and lower this interest rate, which determines how much or how little the federal government will need to pay back in interest. The interest rate should price in the risk of the borrower defaulting. Since the banking system is a fiat currency system, the promise of the US government (Treasury) to pay back debt to the Federal Reserve bank is very low since they can tax to raise funds, and roll over debts to new debt issued by the federal reserve bank. The compounding debt is just staggering.

Savers are losers.

– Robert Kiyosaki

Why is everyone so insistent on saving these dollar notes?

The Federal Reserve bank kept interest rates artificially at zero for an entire decade. This incentivized banks to lend and create new federal reserve notes into the economy at 5,000 year low interest rates. This led to asset bubbles, and stealing the future for present consumption. This made it more difficult for retirees or workers to retire since the assets they want to own have increased to astronomical heights, and made fund managers place investors money into riskier investments due to bonds yielding nothing. Risks retirees cannot afford. The retiree became a child reaching for the top shelf, trying to eat the cookies he helped make, wondering if there are any left once he’s old enough to reach them.

In late 2022, US Federal reserve is hiking interest rates, realizing inflation is out of the stables. With flawed thinking, the Federal Reserve bank is raising interest rates to try to lower inflation. The real issue is a supply problem, not an interest rate problem. With increased supply, prices would naturally lower, and by dramatically raising the interest rate, you are making the difficulty of producing these goods more difficult, creating less goods overall, and keeping inflation high in a doom loop. The US government does not want deflating prices because they need to raise taxes, and cannot raise as much tax on prices that are falling. So there is an incentive to inflate the system. Unlimited printing of dollars. When there is more of something, its price comes down. Supply and demand.

“When you have runaway inflation, it’s punishing the very people who are most productive in society. In other words the people who produce more than they consume, and save the difference. The problem is, those productive people, the savers, save in their national currency, and unfortunately the national currency is just a fiat piece of paper at this point. So when its destroyed through run away inflation, that $100,000 (or $1,000,000) you were hoping to retire on doesn’t exist. And the things you were going to buy and provide from it don’t exist either. Now what are you gonna do?”

– Doug Casey

Notes, bonds, and US dollars will be forever printed into oblivion as long as people believe they still hold some value. The Federal Reserve and US Treasury will keep propelling this system because the world still trusts the value of the currency system over their own. Ultimately, its value is subject to supply and demand. Central banks dislike gold because it requires a physical restraint, limiting the ability to print new dollars out of thin air. Central banks even manipulate the price of gold & silver to this day to instill confidence in the US paper dollar’s value. In the 1970s, one gold ounce was $35. In 2022, one gold ounce is $1800. Who knows what one ounce of gold will buy in dollars in 2050. Our captors have no restraint with an exorbitant privilege.

2020’s CBDC

With Central Bank Digital Currencies (CBDCs) coming soon to a country near you, the ability to print money out of thin air will even be less restrained, and will control every single person’s spending habits. If I want to buy food from you, or if you want to buy gasoline from me, we will have to go through the government directly to transact. This can cause issues due to politics. Your spending habits may not align with the political party in power. You will also be given a personally assigned interest rate due to your gender, race, political party affiliation, spending habits, etc. You will have a different interest rate compared to your neighbor, which could be drastically higher or lower. I may get an interest rate that pays me to get into debt and spend lavishly. You may get an interest rate that is negative, which destroys the value directly of the amount you have on account by charging you to hold funds. This will all be dictated by the political party in power, regardless if they are right or wrong.

This repressive CBDC system already exists in China today. Just like in China, you will download an app, and currency will appear in your account. You will have a social credit score that will dictate the amount you get, and what interest rate you will be given or charged based on your political views and criminal record. You will be controlled, or simply cut off from any account you “own” unless you obey. An Orwellian nightmare come true.

“Every record has been destroyed or falsified, every book rewritten, every picture has been repainted, every statue and street building has been renamed, every date has been altered. And the process is continuing day by day and minute by minute. History has stopped. Nothing exists except an endless present in which the Party is always right…Big brother is watching you.”

– George Orwell, 1984

The answer to 1984 is 1776.

– Alex Jones